Questions?

Feedback?

info@catholicunited.org

Are you one of the 68 percent of American households who takes the standard deduction on their tax form?1 Get ready for some potentially life-changing news: Under the new tax laws, your charitable giving may not be tax-deductible.2

As any good Catholic knows, being charitable is a reward in itself. Tax incentives should not be the sole reason for our giving, but let’s face it, there are financial effects to this new tax reality. If you take into account your tax deductions as part of your financial plan, charitable giving plan or budget process, it is time to consider a change in strategy.

What do you do if your giving doesn’t impact your tax situation? Catholic United Financial Foundation has a creative alternative for people over 70 to consider: Set up a Qualified Charitable Distribution (QCD) plan.

A QCD is a tax-smart plan that allows you to transfer any amount tax-free — up to $100,000 per year — from your IRA directly to a qualified charity. It is only available to IRA owners who are 70½ years of age or older. The federal government requires people age 70 and a half or older to withdraw a portion of their IRA savings every year, called a Required Minimum Distribution (RMD), or they get hit with a hefty fine. Any amount processed as a QCD counts towards your RMD, satisfies your charitable intentions, and can save money on your taxes today and in the future by reducing the taxable amount of your IRA distribution—while lowering your adjusted gross income and taxable income.

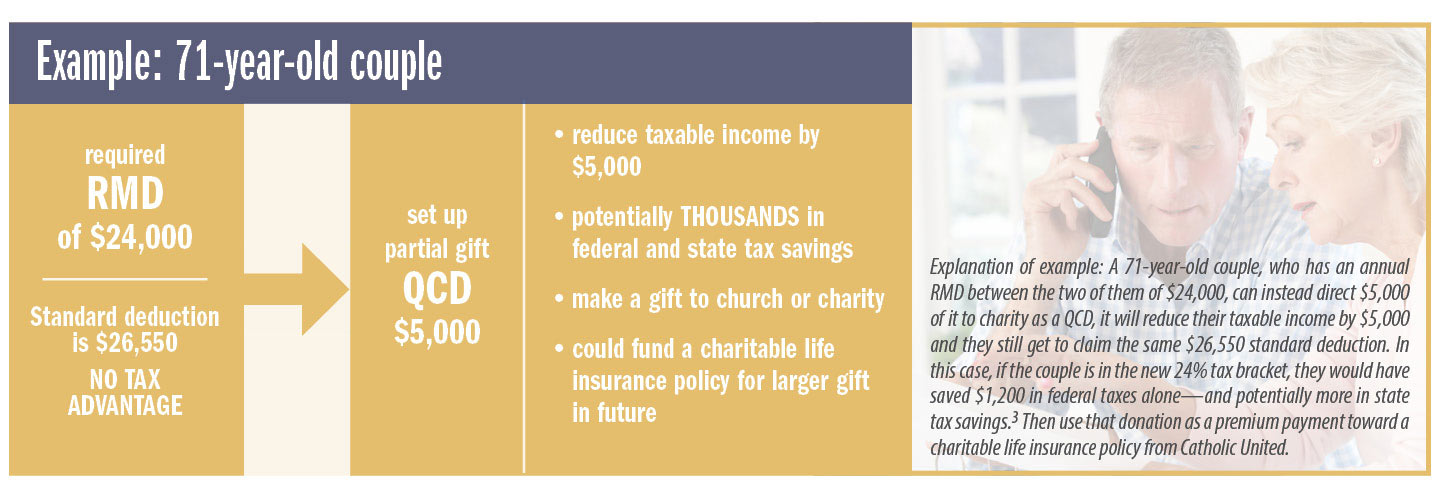

For example, a 71-year-old couple has an existing annual RMD between the two of them of $24,000. They can direct $5,000 to a charity of their choice as a Qualified Charitable Distribution (QCD) directly from an IRA. This will have positive tax benefits:

• By reducing their annual taxable income by $5,000

• Because they still get to claim the same $26,550 standard deduction

• If the couple is in the new 24% tax bracket, they would have saved $1,200 in federal taxes, and potentially more in state tax savings.

This is a potential game-changer for folks who choose the standard deduction.

If that isn’t enough to make you pull out your ledgers and sharpen your pencils, Catholic United Financial Foundation has another creative giving opportunity for people age 70 and older to consider: use a QCD to fund a charitable life insurance policy.

You can use the power of life insurance to make a huge difference to your local charity or Catholic parish. Life insurance provides an “amplified” gift that can be purchased on an installment plan over time, funded through a QCD paid directly to the Foundation which is a qualifying 501(c)3 non-profit charity. This charitable insurance could be written on you, your spouse, adult children, or your parish priest. Through a relatively small annual cost (the premium), a benefit far in excess of what would otherwise be possible can be provided for your charity!

Then reap the benefits of the QCD — no taxes on the distribution which satisfies your RMD, no worries about whether to itemize or take the standard deduction, and best yet, you leverage the premium payments into a much larger gift than you ever thought possible.

Your local Catholic United Financial Sales Representative can explain the benefits of this program, and help you set up your QCD charitable plan. Do you want to see actual numbers? Your rep can provide you with a personalized quote for charitable life insurance. Find yours by clicking here.

1Source: The Tax Foundation, 2016, www.taxfoundation.org/who-itemizes-deductions/

2This information is not intended to be tax advice. Additional rules apply. Please consult your tax advisor with questions about your specific situation.

3Source: Kiplingers.com